XPeng (XPEV) — Why Still Bearish about the Stock

XPeng announced a strategic partnership with Didi today.

Latest Announcement

🔸 XPeng announced a strategic partnership with Didi today.

🔸 XPeng will launch a new brand A-class smart EV, to expand in the mass market segment of the RMB150,000 price range.

🔸 DiDi will provide support from its mobility ecosystem with access to its nationwide shared mobility market.

🔸 XPeng will issue Class A ordinary shares, representing approximately 3.25% of the Company’s outstanding shares, to acquire assets related to DiDi’s Smart EV project. DiDi will thereby become a strategic shareholder of the Company, with a lock-up period of 24 months after the initial closing.

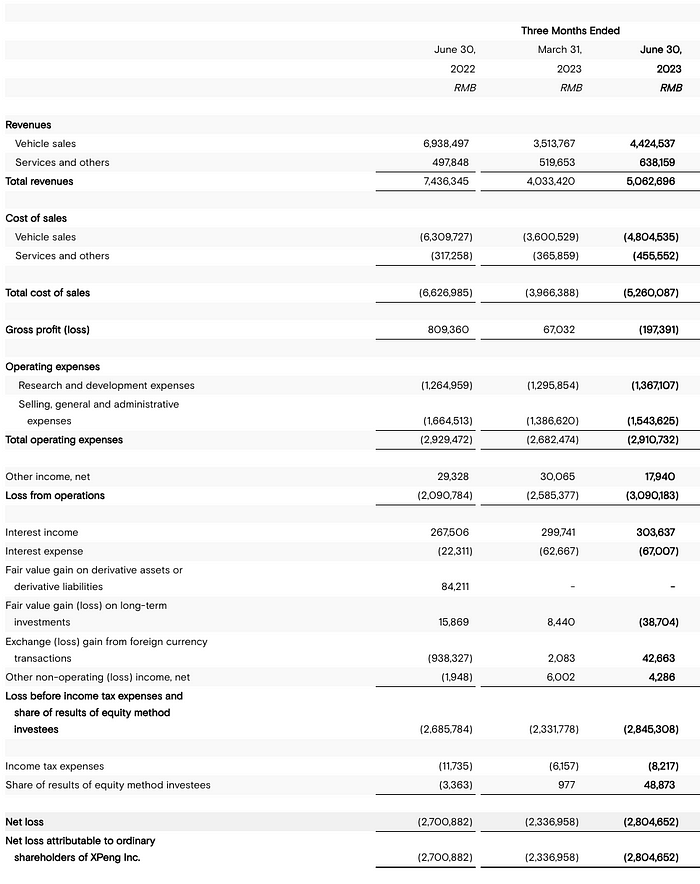

2023Q2 Earnings Results:

🔸Revenue: CNY 5.06B,-31.92% y/y, +25.5% q/q

🔸Net Loss: CNY 2.8B, or 52.53% of total revenue,

🔸Vehicle Deliveries: 23205, -32.6% y/y

🔸Vehicle Sales: CNY 4.42B, -36.2% y/y

🔸Vehicle Margin: -8.6%, worse than 9.1% a year ago.

🔸Gross Margin: -3.9%, worse than 10.9% a year ago.

Investment Thesis

Bullish Opinions:

🔸 Multiple partnerships will drive growth. In addition to the partnership with Didi, Volkswagen also announced in July that it would invest US$700 million in XPeng in exchange for 5% of the shares to establish a partnership, which can help Xpeng Motors expand rapidly in Europe.

🔸 CEO Xiaopeng founded UCWeb, which was acquired by Alibaba for $4.3B, so he understands software very well. XPeng’s self-driving technology is ahead of its domestic competitors. The partnership with Didi has added more imagination to autonomous driving business expansion in the future.

🔸 Based on Volkswagen’s investment, it is estimated that Xpeng’s valuation is around $14B. The current market cap of $15B is relatively reasonable.

Bearish Opinions:

🔸 Total revenue fell 32% y/y and vehicle revenue fell 36% y/y, showing very weak demand.

🔸 Vehicle margin was negative for the second consecutive quarter with no improvement trend. According to current forecasts, Xpeng Motors will not be profitable until 2026.

🔸 The competition in the domestic market is fierce, and XPeng has no obvious advantage.

🔸 Current auto industry faces strong economic headwinds.

🔸 The valuation of XPeng compared with its peers is not low. The current TTM EV/Sales is 4.54, which is not only higher than Li Auto’s 3, and NIO’s 2.64, but even higher than the 4.04 of the Rivian.